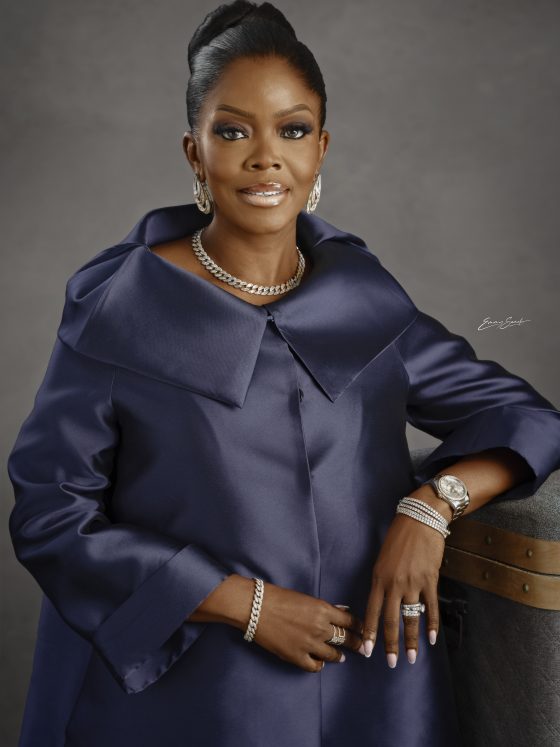

For someone with a career spanning over four decades, Mustafa Chike-Obi’s accomplishments in the financial sector are nothing short of extraordinary. His journey, which began in the early 1980s, has seen him become one of the most respected figures in the global investment banking and financial services landscape. As the Executive Vice Chairman of Alpha African Advisory, Chike-Obi provides unmatched leadership, steering the company through the intricacies of capital raising and investment strategies. With a wealth of experience accrued from working with some of the most prominent names in global finance, his expertise has shaped not only his career but also the industries and institutions he’s touched.

Born with a passion for finance, Chike-Obi’s career took off after he completed his undergraduate studies in Mathematics at the University of Lagos, followed by an MBA from the prestigious Stanford University School of Business. Armed with first-class honours and a keen intellect, he quickly moved up the ranks in Nigeria’s banking sector. His career started at Chase Merchant Bank in the early 1980s, where he served as the Head of Treasury. From there, he went on to become the Founding President of Madison Advisors, a financial services consulting firm based in New Jersey, which specialized in hedge funds and private equity investments. It was here that his expertise began to shine, setting the stage for his future leadership roles.

Chike-Obi’s international experience is equally impressive, having served in senior positions at Goldman Sachs, Bear Stearns, and Guggenheim Partners. His time in the U.S. helped him develop a deep understanding of both mature and emerging markets, particularly in the realm of capital market operations and fixed-income securities. His knowledge of the global financial landscape was instrumental during his tenure as the inaugural CEO of the Asset Management Corporation of Nigeria (AMCON), a government-backed institution created to resolve the non-performing loan crisis in Nigeria’s banking system after the 2008 global financial crisis.

In addition to his roles in finance, Chike-Obi’s dedication to his home country, Nigeria, is evident in his work as a Special Envoy to the United States for the Nigerian government, as well as his leadership positions in various organizations. He currently serves as the President of the Bank Directors Association of Nigeria and the Chairman of Anambra State Investment Promotion and Protection Agency (ANSIPPA), while also holding the chairman seat on the Board of Fidelity Bank.

Funke Babs-Kufeji sits down with Mustafa Chike-Obi in this exclusive interview, where he delves into his extraordinary career, the evolution of the Nigerian financial sector, his insights on global finance, and his vision for Africa’s economic future.

You recently received a Lifetime Achievement Award at the prestigious THISDay Awards, a remarkable honour. How does it feel to have your work recognised at such a high level, and what does this award mean to you personally?

Receiving the Lifetime Achievement Award from ThisDay is both humbling and gratifying. It serves as a testament to the dedication and hard work invested over the years in Nigeria’s financial sector. Personally, this accolade reinforces my commitment to fostering economic growth and stability in our nation.

You’ve built an outstanding career across the financial sector, from investment banking to executive leadership roles. What key lessons from your journey do you think have contributed to your success and leadership style?

Throughout my career, I have always been driven by the simple values of hard work, adaptability, and continuous learning. We are all gifted in one form or another, and this means you may experience or go through phases where others are more gifted than you. The lesson I have learnt in those moments is that whatever gift or skill you don’t have naturally, you can make up with hard work and this guiding principle helped me to achieve success in my career. Embracing change, understanding diverse markets, and prioritising integrity have shaped my leadership approach. Leading by example and fostering collaborative environments have also been crucial in achieving organisational objectives.

Your work spans both mature and emerging markets, particularly in capital markets. How do you approach decision-making in such diverse and complex environs?

In navigating both mature and emerging markets, it’s essential to conduct thorough research and understand the unique economic landscapes, knowing that one works in one clime may not necessarily work in another clime. Engaging with local stakeholders, respecting cultural nuances, and being open to innovative solutions are key to making informed decisions that align with both global standards and local realities.

With over four decades of experience, how have you seen the financial industry evolve, particularly in Africa and Nigeria as a whole, and where do you see the future of the investment sector headed in the next decade?

Over the years, Nigeria’s financial industry has undergone significant transformation, marked by technological advancements and regulatory reforms. Looking ahead, I envision a more integrated African financial market driven by digital innovation and increased intra-continental trade, particularly through initiatives like the African Continental Free Trade Area (AfCFTA).

Having served as CEO of AMCON during a critical period for Nigeria’s financial industry, what was one of the most challenging moments for you, and how did you overcome it?

Leading AMCON during its formative years posed numerous challenges, especially in restoring stability to distressed banks. One particularly daunting moment was addressing the sheer volume of non-performing loans. We overcame this by implementing strategic asset management practices and fostering transparent communication with stakeholders, gradually restoring confidence in the banking sector.

As someone who has worked in both the U.S. and Nigerian markets, how do you think African financial institutions can bridge the gap between global best practices and local realities?

Bridging this gap requires a tailored approach that adapts global best practices to fit local contexts. African financial institutions should invest in capacity building, embrace technology, and develop frameworks that address local challenges while meeting international standards. Collaborations and partnerships with global entities can also facilitate knowledge transfer and innovation.

Alpha African Advisory has played a key role in capital raising across various sectors. What is your vision for the firm, and how do you see it contributing to Africa’s economic growth and development, especially in Nigeria?

During my time at Alpha African Advisory, the vision was to be Africa’s leading catalyst for sustainable economic development. However, following my appointment as Chairman of the board of directors at Fidelity Bank, I had to resign from Alpha African Advisory to assume my duty at Fidelity Bank.

Your leadership spans various sectors, from asset management to financial Advisory. What do you find most fulfilling about your current role at Fidelity Bank Plc, and what keeps you motivated?

The most fulfilling aspect of my role at Fidelity Bank is witnessing the tangible impact of our work on businesses and communities. Seeing enterprises grow, create jobs, and contribute to societal advancement fuels my passion. The continuous evolution of the financial landscape and the opportunity to mentor the next generation of leaders also keep me motivated.

In your experience, what are some of the most common misconceptions about the African investment landscape, and how do you address these challenges in your work?

A prevalent misconception is that Africa is a monolithic entity with uniform risks. In reality, the continent comprises diverse markets, each with unique opportunities. To address this, we provide nuanced insights, conduct comprehensive market analyses, and educate investors on the distinct potential within each region, thereby fostering informed investment decisions.

You have worked with major global players like Goldman Sachs, Bear Stearns, and Guggenheim Partners. How do you balance the intense demands of your career with your personal life and well-being?

Balancing a demanding career with your personal life requires deliberate effort. I prioritise time management, ensuring that I allocate quality time for family and personal interests. Engaging in regular physical activity and maintaining a close-knit support system have been instrumental in achieving this equilibrium.

As the President of the Bank Directors Association of Nigeria and Chairman of the Anambra State Investment Promotion and Protection Agency, how do you see your role in influencing sustainable growth in Nigeria’s financial and investment sectors?

In these capacities, I advocate for sound corporate governance, policy reforms, and investment-friendly environments. By collaborating with stakeholders, we aim to attract both local and foreign investments, promote transparency, and implement strategies that drive long-term economic sustainability in Nigeria.

Having had a fulfilling career in both finance and Advisory, do you have any personal passions or hobbies outside of work that help you unwind or keep you grounded?

Outside of work, I have a deep appreciation for art and enjoy reading. Engaging in community service and mentoring young professionals also brings me immense satisfaction, allowing me to give back and stay connected to the community.

As a successful businessman, what role do you believe style and presentation play in leadership? Does one’s outward appearance have an impact on their professional success?

While substance and competence are paramount, style and presentation play a role in leadership. A professional appearance can enhance credibility and confidence, both personally and in the perception of others. However, it’s essential that outward appearance aligns with inner authenticity and does not overshadow one’s true capabilities and values.

You’re an influential figure in Nigerian and global finance. What advice would you give to young professionals and entrepreneurs seeking to make an impact in today’s world?

I urge young professionals and entrepreneurs to pursue their passions with unwavering dedication. Embrace innovation, seek out mentors, and build networks that can provide support and guidance. It’s essential to maintain integrity, be patient, and stay committed to your vision, even in the face of adversity. Remember, success is a journey that requires perseverance, continuous learning, and a willingness to take calculated risks.

Reflecting on your education at the University of Lagos and Stanford University, how did these formative years influence your career and life approach?

My academic journey began at the University of Lagos, where I earned a First-Class Bachelor’s degree in Mathematics. This rigorous training honed my analytical skills and instilled a disciplined approach to problem-solving. Pursuing an MBA at Stanford University further broadened my horizons, exposing me to global financial systems and innovative thinking. These experiences combined to shape a career grounded in technical expertise and strategic insight.

In your various roles driving Nigeria’s financial sector development, what role do you believe the financial services industry plays in the broader socio-economic development of Nigeria and Africa?

The financial services industry is the backbone of any economy, serving as a catalyst for growth and development. In Nigeria and across Africa, it facilitates capital formation, supports entrepreneurship, and enables infrastructure development. By providing access to credit and financial products, the industry empowers individuals and businesses, fostering economic inclusion and prosperity.

What initiatives or policy changes would you advocate for to attract more international investment and promote sustainable growth in Nigeria?

Nigeria must focus on creating a stable and transparent economic environment to attract international investment. This includes implementing consistent regulatory frameworks, ensuring the rule of law, and combating corruption. Additionally, investing in infrastructure, particularly in power and transportation, will reduce operational costs and enhance competitiveness. Encouraging public-private partnerships and offering incentives for sectors with high growth potential can also stimulate sustainable economic development.

With a distinguished career, do you engage in mentoring within the financial services sector? What guidance do you offer to those aiming for similar success?

Mentorship is a responsibility I hold dear. I advise aspiring professionals to cultivate a strong foundation in their chosen fields, remain adaptable to industry changes, and uphold the highest ethical standards. Emphasising continuous learning and resilience, I encourage them to view challenges as opportunities for growth and to contribute meaningfully to the advancement of the financial sector.